India should take S&P rating with a pinch of salt

The S&P ratings are not the be-all and end-all. Some have criticised agencies for not providing enough details on its methodology. A report published by the World Economic Forum says the ratings have followed an asymmetric path with S&P ratings being the most volatile.

India recently lashed out at the S&P for not upgrading its sovereign credit rating even though it undertook a slew of reforms. The government said the rating agencies should do some “introspection” as global investors felt the country was “underrated”.

Economic Affairs secretary Shaktikanta Das said the reforms undertaken by Asia’s third largest economy were unparalleled in any major economy.

Making his case for a rating upgrade, he even cited the steps taken by the government in the past two years, such as building strong external position, controlling inflation and launching structural reforms such as the goods and services tax and bankruptcy code.

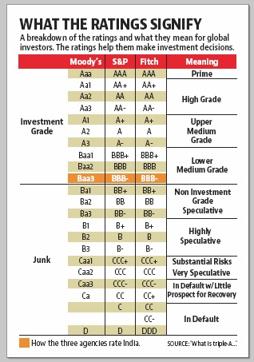

In its report, the agency had reiterated its ‘BBB-’ long-term and ‘A-3’ short-term ratings for India. Though it recognised the improvements in policymaking, it was concerned about India’s wide fiscal deficits, a heavy debt burden, and low per capita income.

The agency says the reform measures, such as improving contract enforcement and trade, boosting labour market flexibility, and reforming the energy sector will show results over the medium term.

Based on its forecasts, the agency doesn’t expect to upgrade India’s ratings this year or next.

In the medium term, it expects improved fiscal performance primarily from revenue-side improvements brought about by the coming introduction of the GST and administrative efforts to expand the tax base.

The S&P justified India’s rating, saying the country’s strong democratic institutions and a free press promote policy stability and predictability.

The criteria

To understand why the agency focuses on certain aspects and not others, we should first look at its methodology. It says the most important factors that determine a sovereign’s rating are the government’s willingness and ability to service its debt on time and in full.

It focuses on an independent government’s performance over past economic and political cycles and factors that indicate greater or lesser economic policy flexibility in future economic cycles.

The five key factors that form the foundation of the agency’s analysis are: institutional and governance effectiveness and security risks, economic structure and growth prospects, external liquidity and international investment position, fiscal performance and flexibility as well as debt burden, and monetary flexibility.

No immediate upgrade of India’s ratings, says S&P

Debt overhang

The S&P says India’s weak public finances and large debt has constrained its ability to improve basic services and infrastructure. The agency says India has a long history of high fiscal deficits (averaging 8.8% of GDP over the past 20 years and 7% in the past five years). India’s general government revenue, at an estimated 21% of 2016 GDP, is low among rated sovereigns.

The deficits have led to the accumulation of sizable general government borrowings (about 69% of GDP) and debt servicing costs (over a quarter of general government revenue).

Moreover, S&P says fiscal consolidation is elusive in the medium term as planned revenues may not materialise and subsidy cuts will be delayed.

Subsidies on food, energy, and fertilisers constitute about 2% of 2016 GDP. The agency projects that net government would decline modestly in the near future.

Stressed banks

With the banking sector having to lend heavily to government via loans and government securities, its capacity to lend to the private sector is limited.

The agency said India had a divided banking sector with private banks being more profitable than public ones that have considerable stressed assets. It estimated that public banks needed a capital infusion of about US$45 billion (2% of GDP) by 2019, given their weaker profitability, to meet Basel III capital norms.

So far, the government has committed US$11 billion (0.5% of GDP) to support public-sector banks. It says the government may have to increase the allocation if the banks are unable to get capital from alternative sources, such as equity markets, additional tier-1 bonds, and insurance companies.

The silver lining

The agency says the ratings could be upgraded if the reforms markedly improve the fiscal output and the government debt falls below 60% of GDP. It qualified its statement, adding the ratings could be downgraded if growth disappoints due to stalling reforms or if the new monetary council doesn’t achieve its targets.

Verdict not sacrosanct

But the S&P ratings are not the be-all and end-all. Some have criticised agencies for not providing enough details on its methodology. A report published by the World Economic Forum says the ratings have followed an asymmetric path with S&P ratings being the most volatile.

The report says the downgrade periods tend to be shorter and deeper than upgrade periods. So a country can be abruptly downgraded but it takes a long time for it to recover its rating or in some cases, the initial status may never be fully regained.

It says these asymmetries are the result of an overreaction to deteriorated economic performance during downgrade periods and an under-reaction to better economic conditions during the recovery phases.

With the agencies facing criticism, the Indian government’s argument may just hold water.

Stay informed on Business News, TCS Q4 Results Live along with Gold Rates Today, India News and other related updates on Hindustan Times Website and APPs