Simplifying data sharing

With the launch of Sahamati, you can now use account aggregator app to share digital financial data with a third party.

So far if you have to take a loan or buy a mutual fund, you will have to provide documents as proof to initiate the process. There is no option where you can share information digitally and instantly to a third party.

With the launch of Sahamati, you can now use account aggregator to share digital financial data with third party. It will be used first in the financial sector followed by telecom, healthcare and other sectors.

Initiated four years ago, four regulators—Reserve Bank of India, Securities and Exchange Board of the India (Sebi), Insurance Regulatory and Development Agency (Irda) and Provident Fund Regulatory and Development Agency (PFRDA) decided to allow regulated entities to share data with users consent.

Account Aggregator

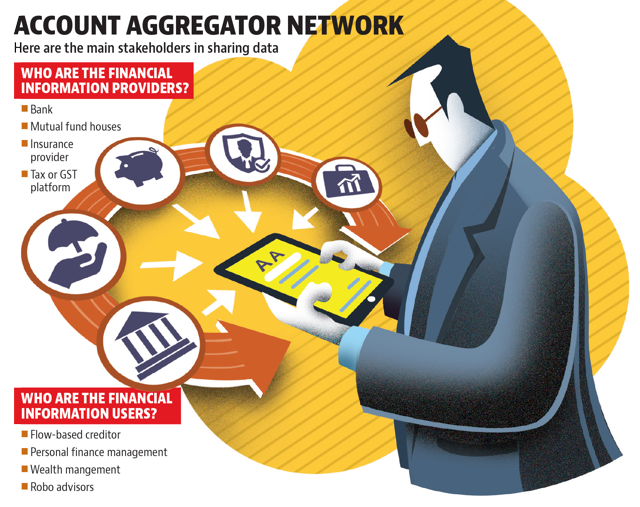

Say you want to take a loan. For the loan you will be asked to provide bank statement. Similarly, say you want to do your financial planning. For this you will be required to provide details about your mutual funds, insurance, provident funds and bank details. The data in the account aggregator app is obtained from multiple services and delivered via consent-based channels to financial information users. With this app, you don’t have to physically visit branches, share confidential log in or log-in to multiple sites to download and collate information before sharing with lenders, financial planners and other service providers. “The account aggregator framework is a critical digital public infrastructure that enables data empowerment,” said Nandan Nilekani, former chairman, UIDAI.

Account aggregator, approved by the RBI will provide services based on the explicit consent of individual clients. This primarily includes transfer, but not storing, of a client’s data. NSEL Asset Data Ltd, CAMS Finserve Financial Services Ltd, Cookiejar Technologies Pvt Ltd, Finsec AA Solutions Pvt Ltd, Yodlee Finsoft Pvt. Ltd and Jio Information Solutions Ltd have got approval to start working on the project. Developed by Indiastack, the framework, titled Data Empower and Protection Architecture (DEPA), is a set of application programme interfaces under the think tank ISPIRT. “The DEPA of Indiastack combines a legal and regulatory framework with appropriate institutional arrangement,” said Siddharth Shetty, fellow, ISPIRT, in the note.

Data Safety

Your data is sent from a financial information provider to financial information user. The data is encrypted and the account aggregator platform also does not have access to the data. No data will be shared without your consent. You have the option to revoke the consent, review, audit and also decide how much data you want to share. Companies who then get access to your data after you consent, reduces the turnaround time to process the loan or investment instrument.

According to Amitabh Chaudhry, CEO, Axis Bank Ltd, the account aggregator holds potential to reduce friction in data sharing and creating new possibilities for financial services.

The Change

It is too early to know the complete outcome of the development. However, account aggregator app has the potential to change the way you currently deal with your financial documents. For instance, if you are looking to do your financial portfolio, your financial planner will require all your investment and income documents. You will either have to send it to the planner on e-mail, via post or give the planner access to your password to auto collect information. With account aggregator app, the sharing of documents manually and multiple times will change. However, for it to work, all financial services will have to come together on the platform. Considering that you can control the quantum of information you share and with consent, gives the consumer more control.

Stay informed on Business News, TCS Q4 Results Live along with Gold Rates Today, India News and other related updates on Hindustan Times Website and APPs