Debt trap: Rs 4.5 lakh cr worth of power projects on the block

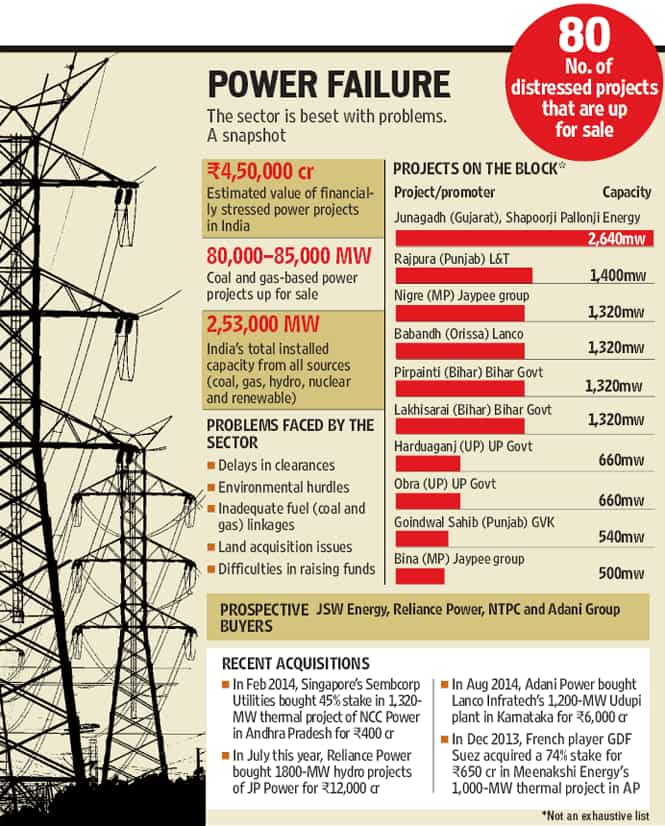

With debt stuck projects languishing for want of fuel and timely clearances, India is currently saddled with a power capacity of 80,000 to 85,000 megawatt (involving an investment of over Rs 4.5 lakh crore) that has been put on the block by developers.

With debt stuck projects languishing for want of fuel and timely clearances, India is currently saddled with a power capacity of 80,000 to 85,000 megawatt (involving an investment of over Rs 4.5 lakh crore) that has been put on the block by developers.

Developers of close to 60,000 MW of coal-based capacity and 20,000 MW of gas-based power capacity in the private and public sector are looking out for potential buyers to ease out the increasing debt burden on their balance sheets.

“With high debt exposure and rising cost of fuel, most power developers are facing losses and are unable to recover their fixed and variable costs...unable to sustain losses, many developers are looking for an exit route,” said Ashok Khurana, who heads the Association of Power Producers—the apex body representing leading private power producers in India.

“Also developers with deep pockets who are ready to buy as they have better holding capacity... given that the valuations of these stressed power projects are currently very attractive, the scenario also offer opportunities for buying these assets,” he added.

India’s largest power producer, state-owned NTPC Ltd, has readied a cash chest of over Rs 10,000 crore to acquire thermal power projects worth 5,000-6,000 MW.

“We will invest anywhere up to Rs 10,000 crore of our cash reserves to acquire thermal power projects while the balance amount will be raised as debt,” said NTPC CMD Arup Roy Choudhury.

JSW Energy, Reliance Power, Adani Power are other private players who are also looking at suitable opportunities to acquire such distressed power projects.

Reliance Power has recently acquired three hydro projects worth 1800 MW from JayPee Associates in a deal valued at close to Rs 12,000 crore.

Last month, Adani Power announced the acquisition of Lanco Infratech’s 1200-MW coal-based Udipi power project in Karnataka for an estimated Rs 6,000-7,000 crore.

The proposed acquisition of stressed projects worth Rs 30,000 crore by NTPC is being seen as one of the largest acquisitions in the sector.

“We have moved ahead and called for bids to select consultants to help us with these acquisitions,” Choudhury. told HT.

A host of infrastructure companies that ventured into the power sector are now keen to move out and are scouting for partners for selling their stakes in these debt-stuck projects currently languishing for want of fuel and other clearances.

Many private firms such as Lanco Infratech, IndiaBulls, GVK, JP Power, Abhijeet group and others are scouting for buyers to stage an exit from such power projects that are idling due to lack of fuel and clearances.

Alongside, the government has already asked banks and cash-rich public sector units such as NTPC and Coal India to float a “reconstruction fund” to buy stakes in such stressed power projects in the country.

“It has been proposed that banks with exposures above Rs 25,000 crore in power projects should pool money in this proposed fund,” a Power Finance Corp (PFC) official said. PFC has been mandated by the power ministry to prepare a feasibility report for floating the fund.

Stay informed on Business News, TCS Q4 Results Live along with Gold Rates Today, India News and other related updates on Hindustan Times Website and APPs