Finance panel formula squeezes Centre’s disposable revenues

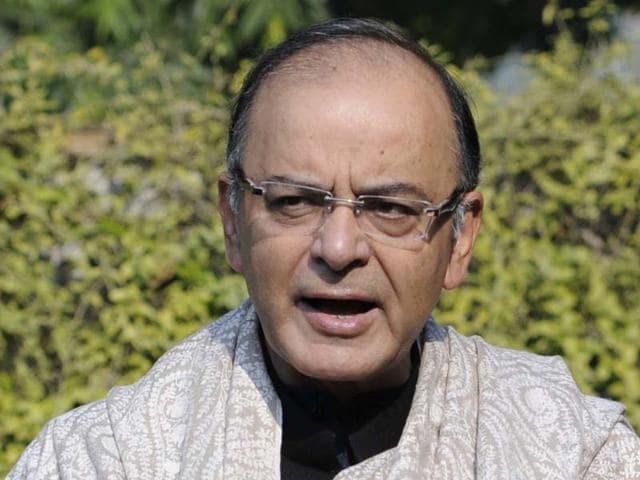

After the new Finance Commission’s recommendations, finance minister Arun Jaitley will have to critically depend on non-tax receipts including disinvestment and spectrum sale to garner additional resources for funding essential expenses.

After the new Finance Commission’s recommendations, finance minister Arun Jaitley will have to critically depend on non-tax receipts including disinvestment and spectrum sale to garner additional resources for funding essential expenses.

Giving out tax concessions would also call for delicate balancing as he has to keep the fiscal deficit under control.

The Narendra Modi-led government will transfer 42% share of Union taxes to states as recommended by the 14th Finance Commission report.

The government, while accepting the recommendations, also admitted that the move would reduce its fiscal space.

“The consequence of this much greater devolution to states is that fiscal space for the Centre will reduce in the same proportion,” the finance ministry said in a statement on Tuesday.

Prime Minister Narendra Modi had also said in his letter to state chief ministers: “This (the recommendations) naturally leaves far less money with the central government. However, we have taken the recommendations of the 14th Finance Commission in a positive spirit, as they strengthen your hand in designing and implementing schemes according to your priorities and needs.”

The commission’s part-time member Abhijit Sen also said in his dissent note that the Centre’s net tax resources would shrink, signalling that a shift to meet states’ demand for larger untied transfers would require a fairly drastic alteration than the current arrangements.

Despite this, the Finance Commission said this would give adequate space to the Union government to keep its fiscal deficit at a recommended level of 3.6% for 2015-16, and subsequently, to 3% in each of the four following years. However, the Centre might have to resort to other means to meet this target.

States will get Rs. 5.79 lakh crore of the Centre’s expected gross tax receipts of Rs. 15.67 lakh crore in 2015-16. The share of states will rise 51.55% compared to the 2014-15 estimate of Rs. 3.82 lakh crore.

The commission also said during the five-year period, the government would have Rs. 49.14 lakh crore left from the divisible pool and once it starts reducing the revenue deficit and eliminate it eventually, it would be healthy for the Centre to maintain a balance.

Stay informed on Business News, TCS Q4 Results Live along with Gold Rates Today, India News and other related updates on Hindustan Times Website and APPs