Are jewellery saving schemes in gold worth?

If you need jewellery in the near future, such schemes are for you. From an investment point of view, deposits work better.

Siddhi Gorivale Tare, a 26-year-old commercial artist based in Mumbai, has been putting a part of her earnings in a jewellery saving scheme. “I wanted to buy a gold bracelet but haven’t been able to do so since I don’t save in a disciplined manner,” she says. She puts an equal amount of money (Rs 2,000) every month and at the end of the 11-month tenure, she will get a benefit of 9.09% (simple interest) and will be able to buy bracelet worth Rs 24,000 she has been eyeing for some time. “It is an easier way to get hold of gold,” she says.

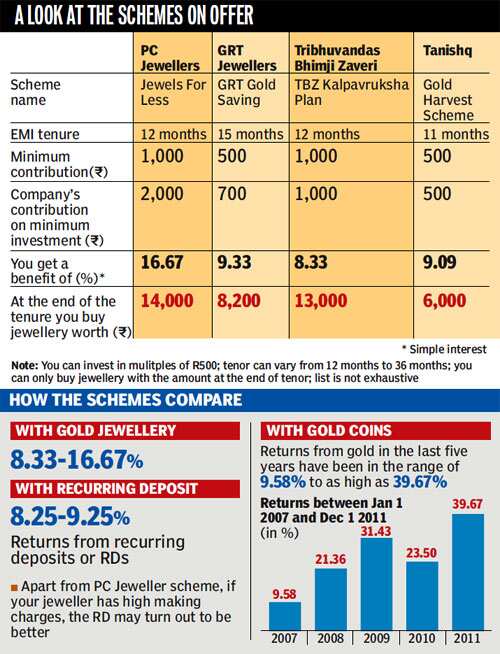

Like Tare, there are several across the country, who are investing in such schemes. For example, branded jeweller Tanishq currently has about 400,000 takers for its Golden Harvest Scheme; Tanishq has had 1.2 million customers till date for this scheme. On the other hand, PC Jeweller Ltd has 45,000-50,000 customers for its jewellery saving scheme. Other established jewellers, including GRT Jewellers and Tribhovandas Bhimji Zaveri Ltd, also have similar schemes.

How do they work?

You invest a fixed amount every month for the chosen tenure and the jeweller adds a month’s installment at the end; some jewellers even pay double the installment. Once the tenure ends, you can buy gold worth the money collected from the same jeweller. The customer can get a benefit of 8.33-16.67% through such schemes.

However, do note that the 16.67% benefit is available only with one jeweller, PC Jeweller. The company reinvests the amount in such a way that besides being able to meet the interest it needs to give to the customer, it gets to keep the additional returns it generates as profit. “The money we get from investors through the jewellery savings scheme is deposited by us in fixed deposits in banks (most of them nationalized banks) and is absolutely safe,” says S Subramaniam, chief financial officer, Titan Industries, the parent company of the jewellery business Tanishq.

Some jewellers use this money for operating expenses or to carry out a company’s normal business activities.

“By getting customers involved in this scheme, we ensure future sales,” says RK Sharma, executive director, PC Jeweller.

The advantages

For those who do not have any other form of saving, this can work well since you buy an asset at the end of the term. “Holding liquid cash is a risk for a majority of Indian women,” says Ashok Minawala, ex-chairman, All India Gems and Jewellery Trade Federation. “Hence, a scheme like this can help them not only save money but also convert it into gold at the end of the tenure.”

The limitations

The first limitation is that you can use the accumulated amount only to buy gold jewellery . So in case you need some accumulated money fo at the end of the tenor, you won’t be able to use this money. Secondly, the jewellery you purchase at the end of the tenure would be available at the prevailing market rates then.

What should you do?

If you are planning to get married in a couple of years and need some jewellery for the same or if you want to gift your daughter, wife or sister but don’t have a lump sum amount, then this scheme is for you. But if your purpose is pure investment, then stay away from such schemes as the making charges of the jewellery and fluctuating gold prices will eat into your returns. A simple recurring deposit will work better for you.

Get Current Updates on India News, Ram Navami Live Updates , Lok Sabha Election 2024 live, Elections 2024, Election 2024 Date along with Latest News and Top Headlines from India and around the world.