As interest rates fall, safeguard your savings with Bajaj Finance FD

Since business and manufacturing activities have slowed down over the last couple of months, this has affected revenues, growth in business prospects and salaries and payments. Thus, spending has taken an economy-wide hit – bringing savings and investments right back into focus.

In the past few months, major industries have witnessed recessionary trends, which came at a time when structural, technological and strategic changes were rife, to address the changing mindset of consumers. Amid these changes, the gradual cuts in repo rates began around February 2019, and in the recent times, the repo rate has been brought down to 4% from 6.5%. The rate cuts and liquidity measures have been as recent as April 17, 2020.

On April 17, 2020, RBI Governor Shaktikanta Das announced various measures to inject liquidity in the economy. The reverse repo rate was also brought down to 3.75% after a 25-basis point cut. These were all clear indicators of RBI’s efforts towards increasing liquidity in the market. However, this may result in exerting downward pressure on interest rates for small savings schemes, fixed deposit, and savings accounts.

Additionally, since business and manufacturing activities having slowed down over the last couple of months, returns on capital are unable to meet their growth targets. This has affected revenues, growth in business prospects and even salaries and payments. Thus, spending has taken an economy-wide hit – bringing savings and investments right back into focus.

Importance of growing your savings steadily

For investors across all income groups, capital preservation has become the top priority during these uncertain times. With markets becoming a victim of large FII sell-out of Rs. 25,000 crores till March 2020, investors must revisit the investment portfolio to re-balance between riskier and risk-free assets in their portfolio. Thus, adding fixed-income instruments like fixed deposit in your portfolio, can help you get assured returns, with high safety of capital amount.

However, given that systemically important institutions such as banks and NBFCs are also facing turmoil which is evident as banks had under-reported their NPAs by Rs. 24,000 crores as on March 31, 2019, it is important that you make an informed choice while selecting your financier.

Invest in a Bajaj Finance FD to get assured returns

For investors looking to grow their savings and get assured returns, Bajaj Finance Fixed Deposit is one of the safest investment avenues. You can also use FD interest rate calculator to determine your fixed deposit return, even before you invest.

Here’s a look at some reasons that make Bajaj Finance FD one of the safest investment options, today.

i.Interest Rates

For any investor, high interest earnings are of prime concern. Make sure to compare FD interest rates between banks and NBFCs as bank FD rates have been steadily going down, following the repo rate cuts.

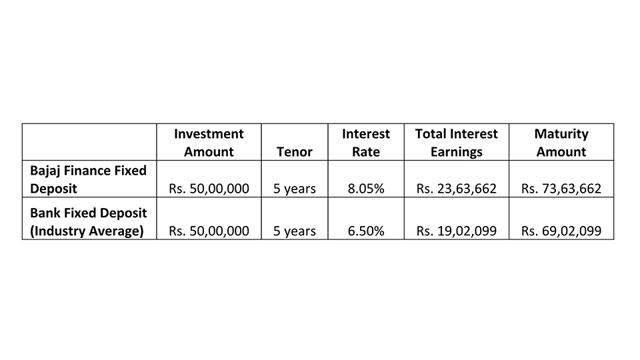

The following comparison shows the difference in the earnings from bank fixed deposits and those of well-placed NBFCs like Bajaj Finance for senior citizen fixed deposits.

Also, Bajaj Finance FD is offering higher interest rates (up to 8.05%) as compared to other fixed-income investments such as Public Provident Fund (PPF) and National Savings Certificate (NSC), SCSS (Senior Citizen Savings Scheme) which are currently offering interest rates of 7.1%, 6.8%, and 7.4% respectively.

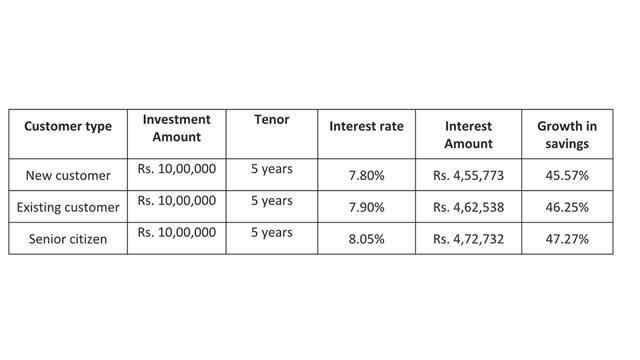

Even new customers can benefit from high FD interest rates offered by Bajaj Finance, and grow their savings by at least 45% even during these times. To understand this better, let’s assume an investment of Rs. 10,00,000 locked into a Bajaj Finance FD for 5 years. The table below shows the growth of savings across different customer segments:

To plan your investments better with fixed deposit, you can also consider using tools like FD interest Calculator to determine the maturity amount, interest payouts and overall fixed deposit returns, before you even invest in FD.

ii.Financial standing – An NBFC’s financial standing is of utmost importance for an investor. Bajaj Finance, as a company, is high on financial revenue as it stands with 11.08% of Net Interest Margin or NIM (as on March 31, 2020) - a primary factor for evaluation of lending and borrowing institutions. Also, Bajaj Finance is the only NBFC with ‘0 unclaimed deposits’.

A high Capital Adequacy Ratio (CAR) indicates the safety of your deposits and Bajaj Finance easily surpasses the standard of 18% with a standing of 25% as on March 31, 2020.

iii.Ease of investing- Investing with Bajaj Finance online FD can enable existing customers to reap the benefit of end-to-end online paperless investment process, making it easy for them to invest online from the comfort of your home.

iv.Utmost safety with high credibility ratings - Bajaj Finance is one of the highest-rated NBFCs in India with an international rating of ‘BBB-’ by S&P Global; while its deposits have earned the highest safety ratings of FAAA/Stable by CRISIL and MAAA (stable) by ICRA. This is as good as any instrument with a sovereign guarantee and the safety of your capital and interest is assured.

v.Trust – Bajaj Finance as an investment company enjoys wide acceptance and trust from senior investors as well as newbie ones. It has 2,35,925 unique FD customers, with a deposit book of Rs. 20,805 crores. Senior citizens especially trust the company with their retirement funds as there are 92,712 unique senior citizen accounts contributing towards a deposit book of Rs. 6,211 crores. These figures indicate the level of trust reposed in the company, by its customers, who’ve continued to invest in this fixed deposit.

vi.Easy Loan against FD – Unforeseen expenses may warrant immediate financial action, leaving most investors with no other option, but to withdraw prematurely. Most FD issuers enable premature FD withdrawals, as per RBI guidelines, albeit with small penalties and loss of interest.

However, Loan against FD is a great solution for investors seeking urgent financing, without losing on their fixed deposit returns. Bajaj Finance, for instance, offers easy Loan against Fixed Deposit at lower interest rates, quick processing, flexible repayment options and minimum documentation.

Additionally, using the FD calculator monthly interest, total FD earnings, maturity amount and your maturity date can also be determined. Thus, you can plan your investments easily with a FD Calculator, and invest online from the comfort of your home.

Locking in to high FD interest rates now, is a prerequisite, amid RBI’s continuous liquidity measures that may induce a downward movement of fixed deposit interest rates. This is evident from the recent reduction of interest rates for not just leading bank FDs, but also government savings schemes and saving accounts.

Thus, it is imperative to lock into your investments at prevailing high FD rates before these rates fall, so you can safeguard your deposits and get assured returns. Choose high safety of your savings, and make a smart choice with Bajaj Finance Fixed Deposit.

Disclaimer: This content is distributed by Bajaj Finserv. No HT Group journalist was involved in the creation of this content.