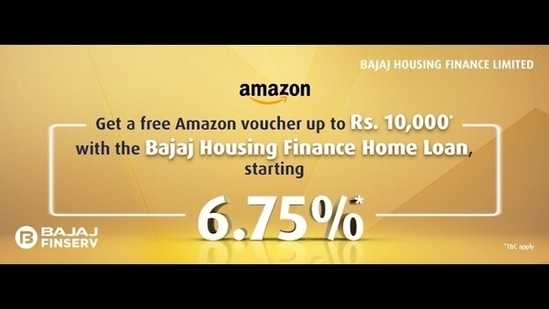

Get a free Amazon gift voucher with an online Bajaj Housing Finance Home Loan

Customers who fill the Home Loan application form on the Bajaj Housing Finance website are eligible for free Amazon vouchers worth up to Rs.10,000. Offer valid till July 22, 2021 on home loans disbursed till July 30, 2021

Reduced home loan interest rates have compelled individuals to invest more in real estate. And external financing in the form of housing loans remains the most preferred option to fund these investments in India.

The growth of the home loan sector, even during these turbulent times, suggests how the RBI’s decision to keep the repo rate at 4% has turned out to be beneficial for housing finance companies.

Since most financial institutions announced a reduction in housing loan rates, finding the right lender can be overwhelming. With competitive interest rates, Bajaj Housing Finance, a wholly owned subsidiary of Bajaj Finance Limited, not only makes the process affordable but also convenient with benefits such as minimum documentation, doorstep service, and other facilities.

Recently, Bajaj Housing Finance Limited (BHFL) announced an exciting proposition for home loan customers in addition to their existing consumer-friendly borrowing terms. Customers stand a chance to get free Amazon vouchers worth up to Rs.10,000 on availing of a home loan through the online home loan application form on the BHFL website.

Below are a few factors that make now the most suitable time to avail of a home loan from Bajaj Housing Finance and finance the purchase of a house.

- Apply for a home loan online from BHFL and get free Amazon vouchers worth Rs.10,000

For borrowers looking to apply for a housing loan, Bajaj Housing Finance Limited has an exclusive offer. Customers need to fill up the home loan application form on the BHFL website before July 22, 2021 to be eligible for the offer. Here are some details on the same.

Individuals get an Amazon Gift Voucher worth Rs.5,000 against a home loan of up to Rs.50 lakh

Individuals opting for a home loan above Rs.50 lakh are eligible for a voucher worth Rs.10,000

Note that the offer is valid only if the loan amount is disbursed before July 30, 2021.

Since this is a limited period offer, prospective borrowers must proceed with their application at the earliest to reap maximum benefits. Apart from this offer, read along to know how the borrowers can benefit by taking credit facilities from BHFL.

- Advantages of Bajaj Housing Finance Home Loans

The affordability of this advance enables borrowers to easily apply for a high-value home loan without having to worry about hefty EMIs. A flexible repayment tenor, online application facility, etc., only add to the convenience of availing of the loan. Besides these, here is a list of other benefits you can expect from home loans offered by this HFC:

- Easy to meet eligibility requirements

The HFC brings easy to meet eligibility requirements that can help borrowers avail themselves of the loan without hassle. A few of these criteria include:

Employment type: Salaried

Age: Between 23 and 62 years of age

Residential status: Indian resident

Experience: Minimum 3 years

- Convenient balance transfer facility

In case you find yourself stuck paying higher interest rates, opting for a home loan balance transfer is your way out. The prospect of reduced EMIs, top-up facilities, etc., are some of the reasons why borrowers go for this refinancing option. With Bajaj Housing Finance, you enjoy a convenient repayment schedule, attractive interest rates, and minimum documentation to ensure faster processing.

- Top-up amount with zero end-use restrictions

From your child’s education fees to home renovation expenses, no matter what your financial requirements are, meet all of them by availing of a top-up loan during home loan refinance. Even though the HFC offers a sizeable top-up amount, make sure you assess your repayment capacity before applying for a large sum.

- Part-prepayment and foreclosure facility

If you are applying for the home loan as an individual buyer, no additional charges will be levied if you decide to prepay before the end of your chosen tenor. Since home loans are considered a long-term commitment, it is advisable to choose the repayment tenor wisely to manage other financial liabilities better.

A home loan EMI calculator is available on the Bajaj Housing Finance website, where you can check different loan amounts and repayment tenor combinations before making a decision.

- Pre-approved offers

The availability of pre-approved offers can make availing of this loan easier for existing customers of the HFC. These offers are available on various financial products, including home loans, loans against property, etc. Therefore, to get yourself a better deal, make sure you check your pre-approved offer by submitting your name and contact details. Apply Online.