Secure your child’s future by investing in a Bajaj Finance online FD

The interest rates offered by Fixed Deposit are usually higher than that of savings accounts. Moreover, the returns are not dependent on any market-driven forces.

Every parent wants their child's future to be financially secure, for which they keep setting their hard-earned money aside, for years. However, sometimes what many parents may not realise is that simply setting savings aside, may not suffice. It is important for mode of savings to evolve over time, so you can keep up with rising inflation indices, or unexpected market volatilities.

Reasons to grow your savings with Fixed Deposit

One of the best ways to ensure consistent growth of savingsis to invest in a Fixed Deposit (FD). As a low-risk financial instrument, FD is offered by banks, post offices, or Non-Banking Financial Companies (NBFCs). The interest rates offered by Fixed Deposit are usually higher than that of savings accounts. Moreover, the returns are not dependent on any market-driven forces. After all, it has been the preferred financial instrument for Indians for decades.

Bajaj Finance offers one of the safest, trusted, and most stable forms of FD investments. Among major FD schemes, Bajaj Finance online FD is one of the most reliable, thanks to the highest stability ratings it has consistently received from credible credit rating agencies like CRISIL and ICRA. It is quick and easy to invest in a Bajaj Finance Fixed Deposit scheme and grow your savings at a fixed and stable rate of interest. Even for those who invest in other market-linked investment instruments, Fixed Deposit is a great way to stabilise your investment portfolio and ensure assured returns.

With fixed returns on your investment, you can secure your child’s future easily. Here are five more reasons for choosing Bajaj Finance online FD over other investment options:

Attractive returns

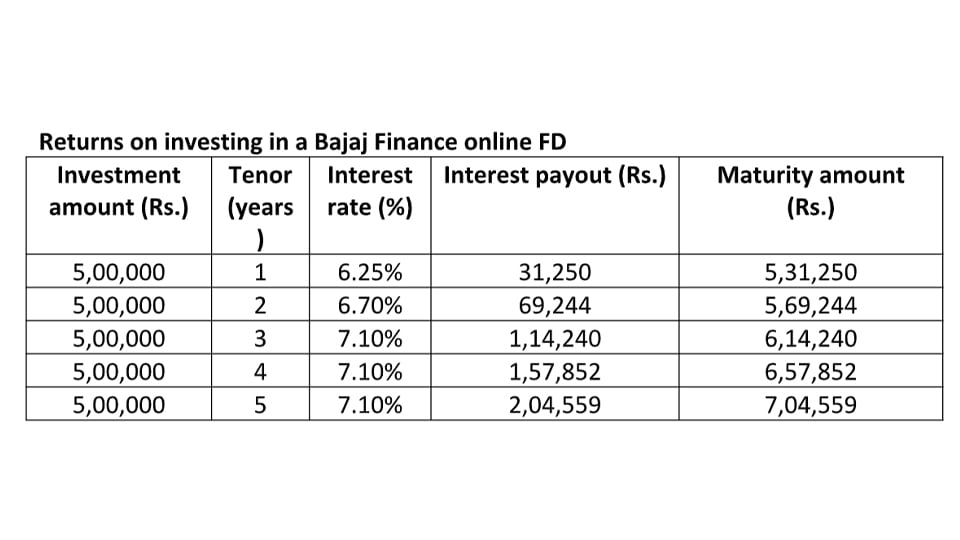

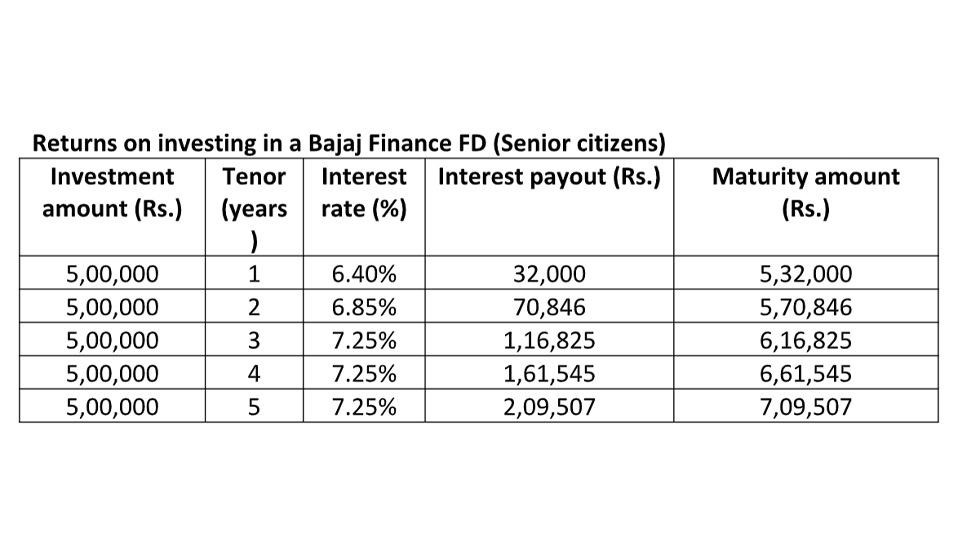

Bajaj Finance FD gives an attractive interest rate of 7% for non-senior citizens. What's more? The cherry on top is the additional 0.10% rate benefit on investing digitally in a Bajaj Finance online FD, which is very convenient and hassle-free. It is even better for senior citizens as the FD interest rates go up to 7.25% for them, regardless of the mode of investment they choose.

Plan your investments better

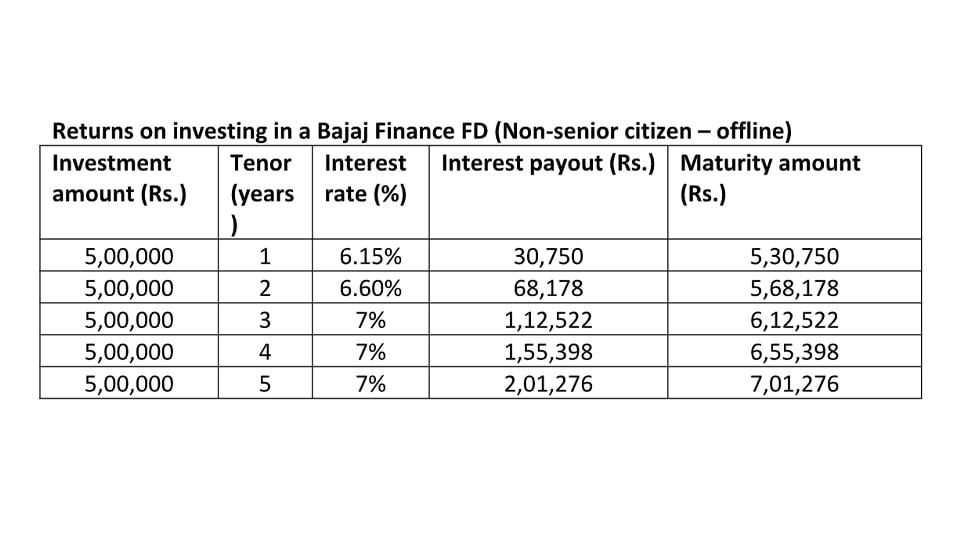

You can invest in Bajaj Finance Fixed Deposit for anywhere between 12 and 60 months. This helps in allaying your worries as you can set different maturity dates for your different investments as per your intended cash flow. Usually, choosing longer tenors can help you grow your savings furthermore. To understand this better, let’s assume you invest Rs. 5,00,000 in a Bajaj Finance FD. Know the returns on your investment, for different tenors, below:

From the above tables, you can see that returns are higher, for longer tenors. This is due to higher interest rates applicable for longer tenors and also because of the effect of compounding.

Would you like to know how much cash you should invest and for what period to gain a specific maturity amount? Use the specially designed FD rate calculator to compare the interest you would receive, by changing the deposit amount, tenor and interest payment frequency. It is a very useful tool to check out your investment horizon.

Auto renewal

For those planning to invest for more than 60 months, Bajaj Finance FD provides auto-renewal facility that can be activated with just 1 click. Simply choose to auto-renew your deposit, at the time of making your deposit and you’re all set.

Monthly savings with Systematic Deposit Plan

What if you don't have a huge amount to invest in a Fixed Deposit in one go? Don't worry. You can start with small monthly savings with Systematic Deposit Plan (SDP), offered by Bajaj Finance. With just Rs. 5000 per month, you can look to grow your savings with tenors ranging from 12 to 60 months. You can also choose between Monthly Maturity Scheme and Single Maturity Scheme, to grow your savings in a systematic manner.

For parents looking to give their kids a monthly stipend, choosing a Monthly Maturity Scheme can be a smart option. Every monthly deposit you make, is considered as a separate FD that matures after the selected tenor.

Additionally, there is an option to save on a monthly basis and get all returns on a single day with Single Maturity Scheme. For parents looking to raise a lumpsum amount for funding their child’s future expenses, this can be a great savings option.

It is for these reasons that Bajaj Finance FD is better than any other FD in the market. You can invest from the comfort of your home, and ensure your child’s future is secure, with assured returns.

Disclaimer: This content is distributed by Bajaj Finserv. No HT Group journalist is involved in the creation of this content.