Where should you invest for guaranteed returns?

Bajaj Finance Fixed Deposit prioritises convenience and safety of investment, in addition to handsome returns.

While it is a known fact that you should invest your money, knowing where to invest and how to go about it is just as important. As the financial market is extremely volatile, you must keep up to date with the latest developments to find offerings that can earn you substantial, guaranteed returns.

Since choosing the best instrument for you can seem like an overwhelming task given these factors, here’s a quick guide on the investments that you should consider in the current scenario to earn stable, sure returns, regardless of whether you’re a first-time or seasoned investor.

NBFC fixed deposits

Due to the latest repo rate cut in October 2019, you may find that fixed deposit investments are likely to bring in lower returns. However, they are still your best bet, as they are stable and offer yield that is unaffected by volatility. When it comes to generating wealth in a reliable, stable and consistent manner, you can count on an NBFC FD, as it offers higher returns compared to bank FDs.

Further, with a reputed financial institution, you can also enjoy additional features that will enhance your experience. A proof of this is the Bajaj Finance Fixed Deposit, as it prioritises convenience and safety of investment, in addition to handsome returns.

This FD has the highest stability and credibility ratings from two of the most prominent credit rating agencies in India: ICRA’s ‘MAAA’ and CRISIL’s ‘FAAA’ ratings. Additionally, it is the only Indian NBFC to have S&P Global’s ‘BBB’ rating. These three accolades speak volumes about the security that you can enjoy. In fact, a book size of Rs.16,000+ crore and an investor base of more than 2.5 lakh customers is further proof that it’s a sound choice.

What makes the Bajaj Finance FD truly a cut above the rest is that you can also benefit from value-added services like the multi-deposit facility and the auto-renewal feature. These help you stay invested for longer, while reducing the effort required at your end. Bajaj Finance also offers industry-leading interest rates through its FD. You can get up to 8.75% as a senior investor, and up to 8.35% as a regular investor, for an FD that has a tenure of at least 36 months with interest payable at maturity.

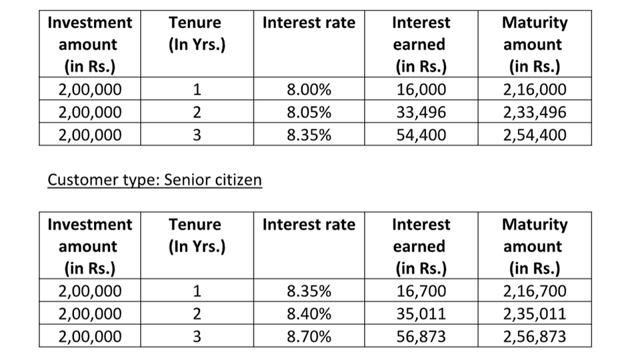

To understand what you stand to earn, consider the following table.

Customer type: New Customer

You can also determine the exact returns you can earn before you start investing, by using the FD Calculator. All you need to do is enter the intended investment amount and tenure.

Public Provident Fund

Investing in PPF is a good way to grow your wealth over an extended period of time. This is because the money is locked in for a 15-year tenure and during this time your corpus grows steadily. As per recent updates, the applicable PPF interest rate sits at 7.9%.

A PPF investment works best when the goal is to build a healthy retirement fund. This is because you cannot withdraw funds until the 7th year of investment. Additionally, you can also extend the investment at the time of maturity in five-year blocks at the prevailing interest rate.

National Pension Scheme

This government scheme is another way to invest for your retirement. Through NPS, you can choose between two options: auto and active. These dictate your involvement with the investment and earnings. In case of the former, your funds are automatically invested in equity, bonds or government securities. On the other hand, if you can choose the latter, your involvement in where to invest is greater. As per the scheme regulations, NPS matures only when you turn 60 years of age.

While the above-mentioned options serve vastly different goals, it is essential to consider factors like lock-in period, interest rate on offer and the risk involved. A fixed deposit stands out amongst these 3 options as it promises admirable returns, immense flexibility, near unmatched safety and is ideal for both short- and long-term goals.

For those looking for a quick and convenient investment option, Bajaj Finance online FD is a great way to grow your savings. All you have to do is fill the application form and authorise a representative to contact you. Thereafter, leverage the multi-deposit facility, auto renewal facility and other unique features to power your finances.

Disclaimer: This content is released by Bajaj Finserv. No HT journalist is involved in creation of the content.