Interest on PPF and other such small savings schemes cut: What this means

The government on Friday slashed interest rates on small savings schemes, including Public provident Fund (PPF) and Kisan Vikas Patra (KVP), by 10 basis points to align them with market rates.

The government on Friday slashed interest rates on small savings schemes, including Public provident Fund (PPF) and Kisan Vikas Patra (KVP), by 10 basis points to align them with market rates, a move that may facilitate further rate cuts by commercial banks in the absence of policy rate cuts by the Reserve Bank of India (RBI).

A basis point is one-hundredth of a percentage point.

RBI is expected to hold rates in its quarterly monetary policy review on April 6. The central bank in its last policy review in February changed its stance to neutral from accommodative, citing inflationary pressure. However, the linking of interest rates of small savings schemes to the yields of government bonds is expected to allow banks to pass on policy rate cuts by the central bank through lower lending rates.

“We are doing it keeping in mind the interests of small investors,” economic affairs secretary Shaktikanta Das said.

So, should you rethink your investments in these schemes?

Rate cuts

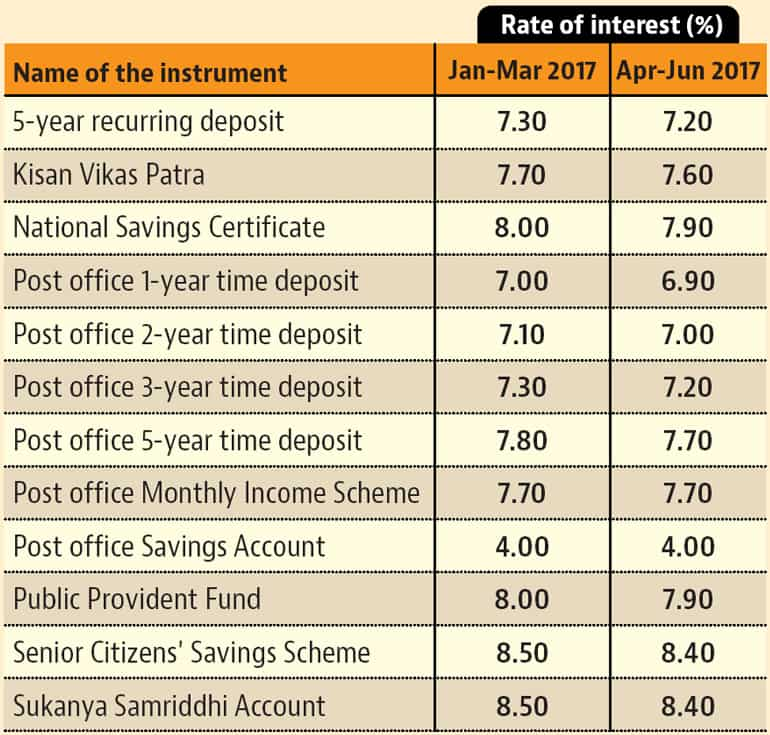

According to the finance ministry notification, the interest rate on a savings accounts with post offices will stay at 4% annually, whereas all other schemes will fetch 0.10% less starting next quarter. Investments in PPF will fetch an annual interest rate of 7.9%, compared to 8% in the quarter ending March 2017; similarly five-year National Savings Certificate will give interest of 7.9% instead of 8%. KVP investments will now provide 7.6% return and mature in 113 months.

The scheme for the girl child, Sukanya Samriddhi Account Scheme, and five-year Senior Citizens Savings Scheme will provide 8.4% return. The five-year monthly income scheme will offer 7.6% returns. Term deposits of 1-5 years will offer 6.9-7.7%. The five-year recurring deposit will earn 7.2% interest.

Should you keep investing?

“0.10% decrease in the interest rate of PPF is not huge in the current falling interest rate scenario. Given that PPF still offer a return of 7.9%, that too tax free, which no other instrument provides, one can continue investing in it,” said Suresh Sadagopan, founder, Ladder7 Financial Advisories, a Mumbai-based financial planner.

However, when it comes to other small savings schemes such as time deposits, where returns are not only low but are taxable too, “one should look for alternatives,” Sadagopan suggested.

“An investor can consider investing in a debt mutual fund instead, if the time horizon for investment is more than three years. Though debt mutual funds will also provide similar returns, but available indexation benefit while calculating tax on return will increase the investor’s overall profit.”

(Published in arrangement with Livemint)

Stay informed on Business News, TCS Q4 Results Live along with Gold Rates Today, India News and other related updates on Hindustan Times Website and APPs