Paytm targets credit and debit cards in big offline retail push

Vijay Shekhar Sharma has a rival, and it is big — cash. The founder and CEO of Paytm, India’s largest mobile wallet company is looking to take his battle to cash transactions, and wants to take over 30% of these this year.

Vijay Shekhar Sharma has a rival, and it is big — cash. The founder and CEO of Paytm, India’s largest mobile wallet company is looking to take his battle to cash transactions, and wants to take over 30% of these this year.

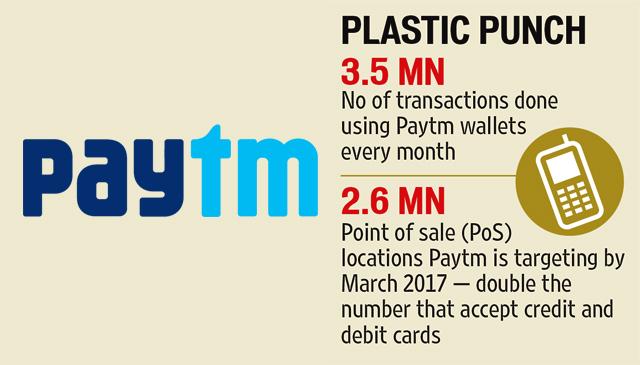

Before that, he wants to overtake the number of point-of-sale (PoS) terminals that accept credit and debit cards by March next year. Cards are accepted at close to 1.3 million PoS locations, according to Reserve Bank of India. Paytm claims it will have 2.6 million offline merchants.

Its wallets are already almost six times the number of credit cards, at 120 million. There are 21.11 million credit cards, according to RBI. Sharma next wants to carry the battle to offline merchants. “Wallets solve payments as a problem. Now that many of our merchants are used to sell using our app, we will see many of them accept Paytm money in their stores,” Sharma said.

Three months into offline transactions, Paytm is doing 3.5 million transactions every month. “It is our fastest growing business,” said Nitin Misra, VP at Paytm. To sign up merchants, the company has engaged more than 600 people and is adding 100 every month. It has about 100,000 merchants so far, and claims to be adding more than 7,000 every day.

The hook? No transaction fees, unlike credit card companies which charge up to 2% in commission from merchants.

But Paytm has competition: Snapdeal-owned Freecharge (with 20 million wallets), which started wallet services in September and has partnered with Mc Donald’s and Shopper’s Stop. “We will be using existing swipe machines for payments,” said Govind Rajan, chief strategy office of Snapdeal.

A user has a dynamic five-digit number always available on the Freecharge app, which need to be entered in the swipe machine. “The payment happens within 10 second, faster than a cash and card transaction,” said Rajan, who says every offline merchant is a potential Freecharge user.

This might be the cusp of a digital payments revolution.

Stay informed on Business News, TCS Q4 Results Live along with Gold Rates Today, India News and other related updates on Hindustan Times Website and APPs