KKR acquires stake in Vini for $625 million

The founders, led by brothers Darshan and Dipam Patel, will continue to hold a significant stake in Vini and collaborate with KKR to drive the company’s growth, the private equity firm said in a statement on Monday.

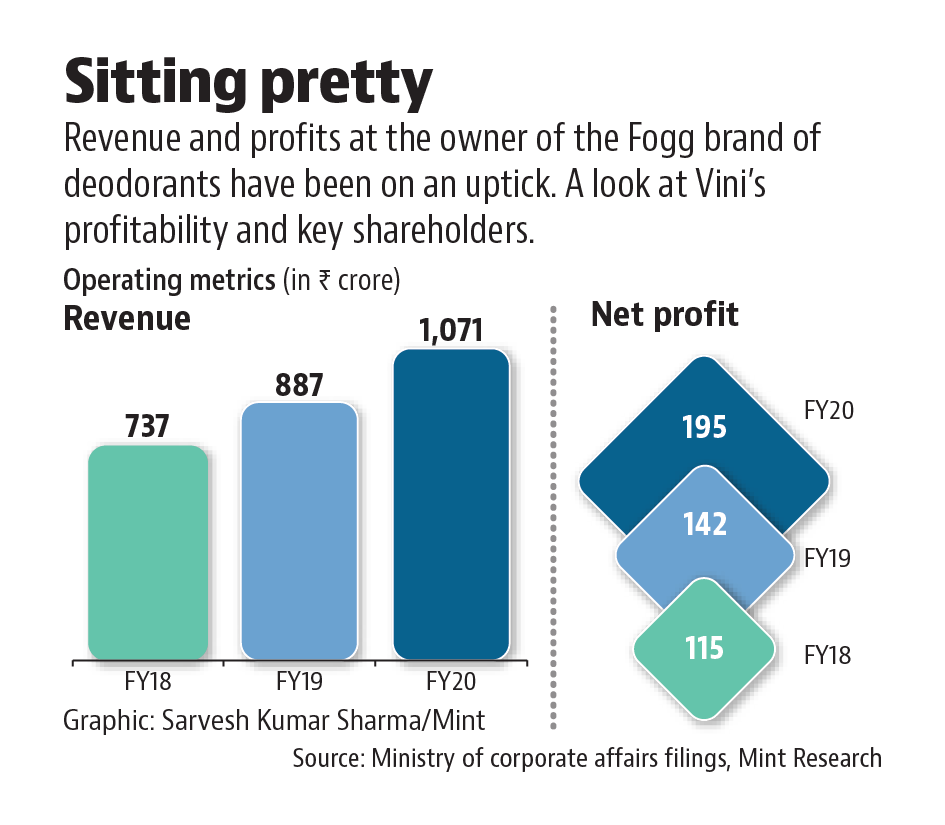

KKR & Co. agreed to buy a controlling stake in Vini Cosmetics, the owner of the Fogg brand of deodorants, from the founders and Sequoia Capital for $625 million, betting that Indian consumers will continue to spend big despite the disruption caused by the pandemic.

The founders, led by brothers Darshan and Dipam Patel, will continue to hold a significant stake in Vini and collaborate with KKR to drive the company’s growth, the private equity firm said in a statement on Monday. Existing investor WestBridge Capital will also acquire an additional stake from Vini’s founder group to raise its shareholding.

While the financial details were not disclosed, a person aware of the deal said KKR will buy around 55% in Vini Cosmetics, valuing it at more than $1.1 billion. The Patel family owns around 61.68% of the company, with Sequoia and WestBridge Capital holding the rest, according to company filings with the ministry of corporate affairs.

The transaction reflects the continued interest of private equity investors in the Indian consumption growth story, industry experts said.

“Despite the pandemic, consumer goods companies and brands have seen demand only grow. Most FMCG firms are doing well. The number of consumers is growing, and investors continue to bet on this trend,” said Harminder Sahni, founder and MD, Wazir Advisors.

Founded in 2010, Vini manufactures, markets and distributes its branded deodorants, cosmetics and toiletries through its flagship brand Fogg and other brands such as Ossum and GlamUp. It sells its products through a network of 700,000 points of sale and 3,000 dealers. Vini’s products are also sold in South and West Asia.

Darshan Patel started Vini after his family sold its pharma business, Paras Pharmaceuticals, to Reckitt Benckiser in 2010.

Sahni said investors are particularly keen on firms with a wide distribution network, such as Vini. “Also, we have seen that in online commerce—whose share is only increasing—the winners have always been the stronger brands,” Sahni said.

Patel will remain the chairman of Vini’s board, and Dipam will be named vice chairman.

Stay informed on Business News, TCS Q4 Results Live along with Gold Rates Today, India News and other related updates on Hindustan Times Website and APPs