Budget 2017: Jaitley bets on rural, infra spending to beat demonetisation blues

Finance minister Arun Jaitley on Wednesday sought to ramp up spending on rural areas and infrastructure as well as hand out marginal tax relief to the middle-class and small businesses in his budget proposals for 2017-18, which he said will help beat the fallout of demonetisation.

Finance minister Arun Jaitley on Wednesday sought to ramp up rural and infrastructure spending and handed out marginal tax relief to the middle-class and small businesses in his budget proposals for 2017-18.

Acknowledging the “legitimate expectation” of relief in the middle class and cash-only informal sector, Jaitley said the budget will help beat the fallout of the government’s demonetisation initiative. The government’s decision to ban currency notes of Rs 500 and Rs 1,000 denomination on November 8 last year sent ripples through the economy that was already battling slowing demand and sluggish investment.

The budget proposed to halve the rate for taxpayers in the lowest slab of up to Rs 500,000 — from 10% to 5% — and cut it from 30% to 25% for enterprises with a turnover of less than Rs 50 crore. Jaitley said the foregone revenue would be made up with a surcharge of 10% on the tax paid by individuals whose annual income is between Rs 50 lakh and Rs 1 crore. The 15% surcharge on tax paid by individuals with income above Rs 1 crore remained unchanged.

There weren’t many changes in other taxes as the government hopes to soon roll out a unified goods and services tax (GST) to replace existing indirect taxes such as excise duties, customs duties and service tax. Jaitley strongly reiterated the new July 1 deadline for implementing GST.

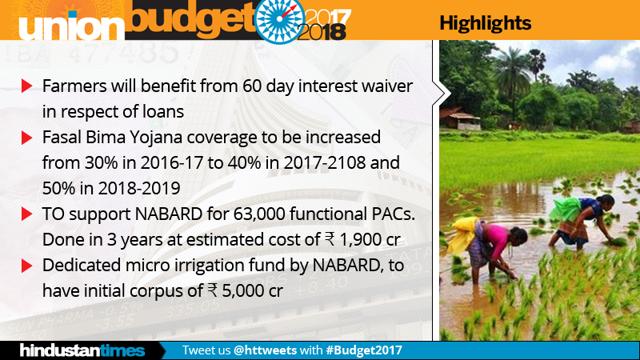

The focus of this budget, however, was on the rural economy and the need to step up public investment to help overcome the impact of demonetisation and revive growth. Jaitley announced several measures in this regard, but was cautious enough to not let up too much on government spending.

“My approach in preparing the budget is to spend more on rural areas, infrastructure and poverty alleviation with fiscal prudence,” he told Parliament, adding that the impact of demonetisation would not spill over to the next financial year.

He pegged the fiscal deficit target at 3.2% of GDP (gross domestic product) for 2017-18, slightly higher than the earlier aimed-for 3%. Out of the Rs 21.5-lakh crore budget, Jaitley plans to spend Rs 3.9 lakh crore, or 18%, on infrastructure, Rs 1.9 lakh crore, or about 10%, on rural, agriculture and allied sectors and transfer Rs 4.1 lakh crore, about 19%, to state governments for their projects.

Jaitley’s budget also appeared to keep an eye on a string of state elections beginning this week, where the so-called demonetisation move is likely to influence the vote, among other things. He increased funds allocated for the Scheduled Castes by a third to Rs 52,000 crore, saying that many new enterprises had been set up under the Stand Up India programme, aimed at helping women, Dalit and tribal entrepreneurs.

The increased allocation could help the BJP, especially in Punjab, where Dalits are a third of the population, and in Uttar Pradesh, where Scheduled Castes can make a difference in at least 100 seats. The two states are among the five that will vote to elect a new government this month.

The finance minister also used the occasion to strongly defend his government’s move to demonetise and push digital transactions. “We are moving from informal to formal economy and the government is now seen as a trusted custodian of public money,” he said.

But the digital ecosystem was left wanting, as they were expecting sops to incentivise cashless transactions. While Jaitley removed service charge on rail ticket bookings through IRCTC, doled out tax exemptions of manufacture and import of digital payment devices, what the sector remained waiting for were tax breaks for merchants accepting cashless payments. Several mobile wallet companies said that they expected government support to help them survive fierce competition and low margins in the sector.

For more stories on Union Budget 2017, click here