‘Want emergency fund, insurance for cabbies’: Vijay N

For the 2021 Union budget, Vijay N wants the government to create an emergency fund for drivers and provide insurance to cab drivers. “Drivers who have been operating for six months and do not have any accident on record should be provided with an emergency fund facility,” he said.

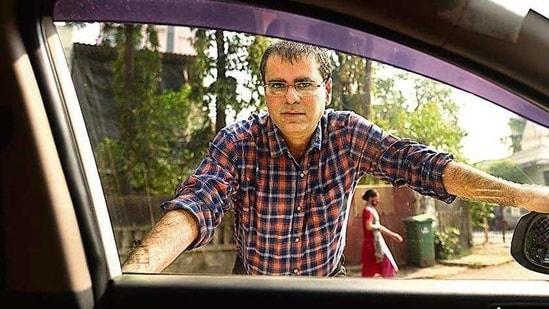

In December 2017, Vijay N was on his way to the Chembur gymkhana for a party thrown by his office. He was a production head at a private firm at the time, and made about Rs25,000 per month. During the 50-minute journey, he got talking with his cab driver, who said that his income had ballooned since he registered with a cab-hailing app company. “I realised that operating cabs is a good income venture and decided to quit my job,” said Vijay, 44.

Three months later, he quit his company, used his savings to buy a Hyundai Accent car, registered himself on multiple app-based cab platforms, and hit the road. He would get a minimum of 10 rides, between his home in the suburb Navi Mumbai and downtown Mumbai, a distance of around 25km.

The sole breadwinner in a family of five, Vijay was able to put his two children in good schools, and save extra money. “I would easily earn up to one lakh rupees a month,” he said.

After two years in the cab business, his business hit a trough this March as Covid-19 started spreading across the country. Then, on March 25, the government clamped a nationwide lockdown to curb the spread of the virus, and Vijay’s car went off the road.

During the 68-day national lockdown, Vijay started selling face masks and used his savings to run the household. “I had some savings and no car loan, which helped me.” he said.

Even when the lockdown was partially lifted in June and cars allowed to ply, Vijay was left struggling. Mumbai was the worst-hit city in India at the time, and the daily surge prompted most people to stay indoors. “As the situation got worse, business got completely paralysed. After resuming operations, we really struggled to make half of what we made earlier,” he said.

Two of the leading cab-hailing apps, Ola and Uber, employ close to 2.5 million drivers, whose incomes reduced by half after the lockdown was lifted in June, studies have shown. In September, large sections of Ola and Uber drivers struck work in Delhi and Mumbai, demanding additional protections and lower commissions.

“We are slowly getting back to earlier levels of business, but the Goods and Service Tax(GST) on rides should be reduced ” he added. During the lockdown, some companies provided a loan of Rs.3,600 to drivers.“The amount is being taken back by the companies now.” he said.

For the 2021 Union budget, Vijay wants the government to create an emergency fund for drivers in the transport industry and provide insurance to cab drivers. “Drivers who have been operating for six months and do not have any accident on record should be provided with an emergency fund facility,” he said.

Vijay hoped for subsidised insurance cover of all drivers and regulation for cab aggregator companies.

Vijay also wants the government to control fuel prices.

“People who are driving diesel vehicles are crying. The amount the companies provide as fuel is way less to the actual amount being spent by the drivers. Immediate measures should be taken to bring the fuel prices down,” he added.